nh meals tax payment

There are however several specific taxes levied on particular services or products. Depending on the type of business where youre doing business and other specific regulations that may apply there may be multiple government agencies that you must contact in order to get a New Hampshire Meals Tax Restaurant Tax.

Pin By Park Inn By Radisson Gurgaon B On Park Inn Radisson Bilaspur Happy Family Meals Food

Exact tax amount may vary for different items.

. 85 of the listing price including any cleaning fee and guest fee for reservations 184 nights and shorter. New Hampshire Meals and Rooms Tax Database Author. Failure to comply with state and local tax laws can result in fines and interest penalties.

Use the link on the left side of page Payment Options to make a payment on-line by credit card or e. Under New Hampshire State law I am now obligated to collect the 9 Meals Rooms MR tax for the NH Revenue Administration. The tax must be separately stated and separately charged on all invoices bills displays or contracts except on those solely for alcoholic beverages.

The rate is 75 of the vendors gross receipts from restaurant meal sales. New Hampshire Department of Revenue Administration Governor Hugh Gallen State Office Park 109 Pleasant Street Medical Surgical Building Concord NH 603 230-5000 TDD Access Relay NH. Please note that effective october 1 2021 the meals rentals tax rate is reduced.

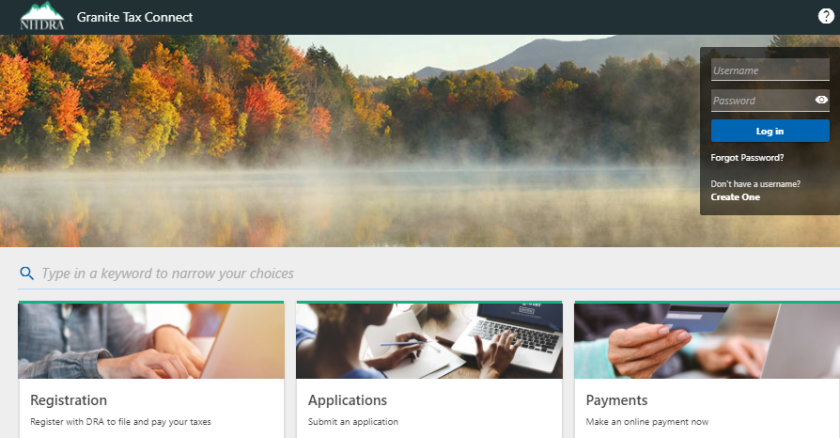

Please visit GRANITE TAX CONNECT to create or access your existing account. The meals and rentals mr tax was enacted in 1967. E-file fees do not apply to NY state returns.

The tax applies to any room rentals for less than 185 consecutive days and to function rooms in any facility that also offers sleeping accommodations. This local excise is imposed along with the state sales tax on meals bringing the effective tax rate on sales of meals to 7 in a city or town that has decided to adopt it. Be sure to visit our website at revenuenhgovGTC to create your account access today.

Tax exempt meals and rental receipts 21 mail to. Tax authorities require short-term vacation rental hosts to collect applicable short-term rental taxes from their guests and remit them to the proper authorities. 603 230-5945 Contact the Webmaster.

2022 New Hampshire state sales tax. New Hampshire Meals and Rooms Rentals Tax. For detailed information please visit the New Hampshire Department of Revenue website.

That includes some prepared ready-to-eat foods at grocery stores like sandwiches and party platters. Tax Returns Payments to be Filed. A 9 tax is assessed upon patrons of hotels and restaurants on meals alcohol and rooms costing 36 or more.

New Hampshire is one of the few states with no statewide sales tax. The New Hampshire state sales tax rate is 0 and the average NH sales tax after local surtaxes is 0. Starting October 1 the tax rate for the Meals and Rooms Rentals Tax will decrease from 9 to 85.

New Hampshires meals and rooms tax is a 85 tax on room rentals and prepared meals. If I dont collect this tax I can be forced to pay the tax penalized and put into other legal jeopardy. Enter your total Tax Excluded Receipts on Line 1 Excluded means that the tax is separately stated on the customer receipt or check.

Find out more about how occupancy tax collection and remittance by Airbnb works. Like hotel and BB stays short-term rentals in New Hampshire are subject to tax. The new hampshire income tax.

The State of New Hampshire does not issue Meals Rentals Tax exempt certificates. The NH Department of Revenue Administration has made it easier to file your Business Enterprise Taxes Business Profits Taxes Interest Dividends Taxes Meals Rentals Taxes and Real Estate Transfer Taxes online using Granite Tax Connect. 603 230-5920 109 Pleasant Street Medical Surgical Building Concord NH 03301.

Please mail TAX PAYMENTS ONLY to the following address. 603 230-5920 109 Pleasant Street Medical Surgical Building Concord NH 03301. Yes most NH taxes may be paid online.

A New Hampshire Meals Tax Restaurant Tax can only be obtained through an authorized government agency. Businesses register to collect meals tax with MassTaxConnect. A 9 tax is also assessed on motor vehicle rentals.

Meals and Rooms Operators. Vendors must add a 625 sales tax to the selling price of every meal and collect it from the purchaser. Find Out Today If You Qualify.

Multiply this amount by 09 9 and enter the result on Line 2. NH Department of Revenue Reminds Taxpayers of Meals and Rooms Tax Rate Reduction. This new system will replace our current e-file system for Real Estate Transfer Tax counties DP-4 payments as of January 1 2022.

The new hampshire income tax has one tax bracket with a maximum marginal income tax of 500 as of 2022.

New Hampshire Income Tax Nh State Tax Calculator Community Tax

Transparency Nh Department Of Revenue Administration

Historical New Hampshire Tax Policy Information Ballotpedia

What Kind Of Taxes Will You Owe On New Hampshire Business Income Appletree Business

Pin By Bellshomestead On Planning Our Homestead Food Protection Prepared Foods Things To Sell

Nh Meals And Rooms Tax Decreasing By 0 5 Starting Friday Manchester Ink Link

New Hampshire Meals And Rooms Tax Rate Cut Begins

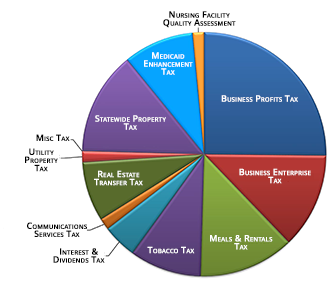

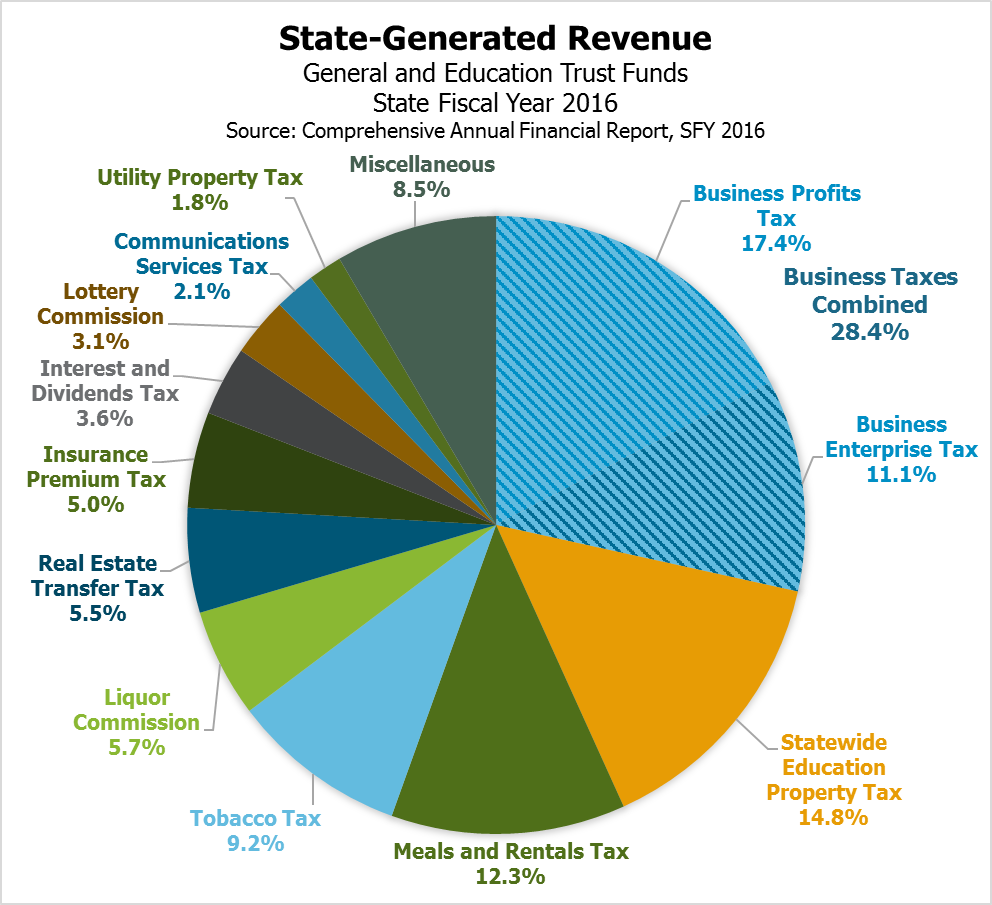

Revenue In Review An Overview Of New Hampshire S Tax System And Major Revenue Sources New Hampshire Fiscal Policy Institute

Statewide Education Property Tax Change Provides Less Targeted Relief New Hampshire Fiscal Policy Institute

New Hampshire Revenue Dept Launches Final Phase Of Tax System

Pin By Mikehardwick On Quick Saves In 2021 Truck Camper Lance Campers Truck Bed Camper

Sununu S Pitch To Suspend Rooms And Meals Tax Worries Nh Town Officials

Everywhere Kids Eat Free In Nh Kids Eat Free Eat Free Children Eating

New Hampshire Income Tax Nh State Tax Calculator Community Tax

New Hampshire Income Tax Nh State Tax Calculator Community Tax

Cut To Meals And Rooms Tax Takes Effect Nh Business Review

Hotel Nh Noordwijk Conference Centre Leeuwenhorst Nh Hotels Com

Surprising Data Reveals The Top 25 Tax Friendly States To Retire Retirement Tax States